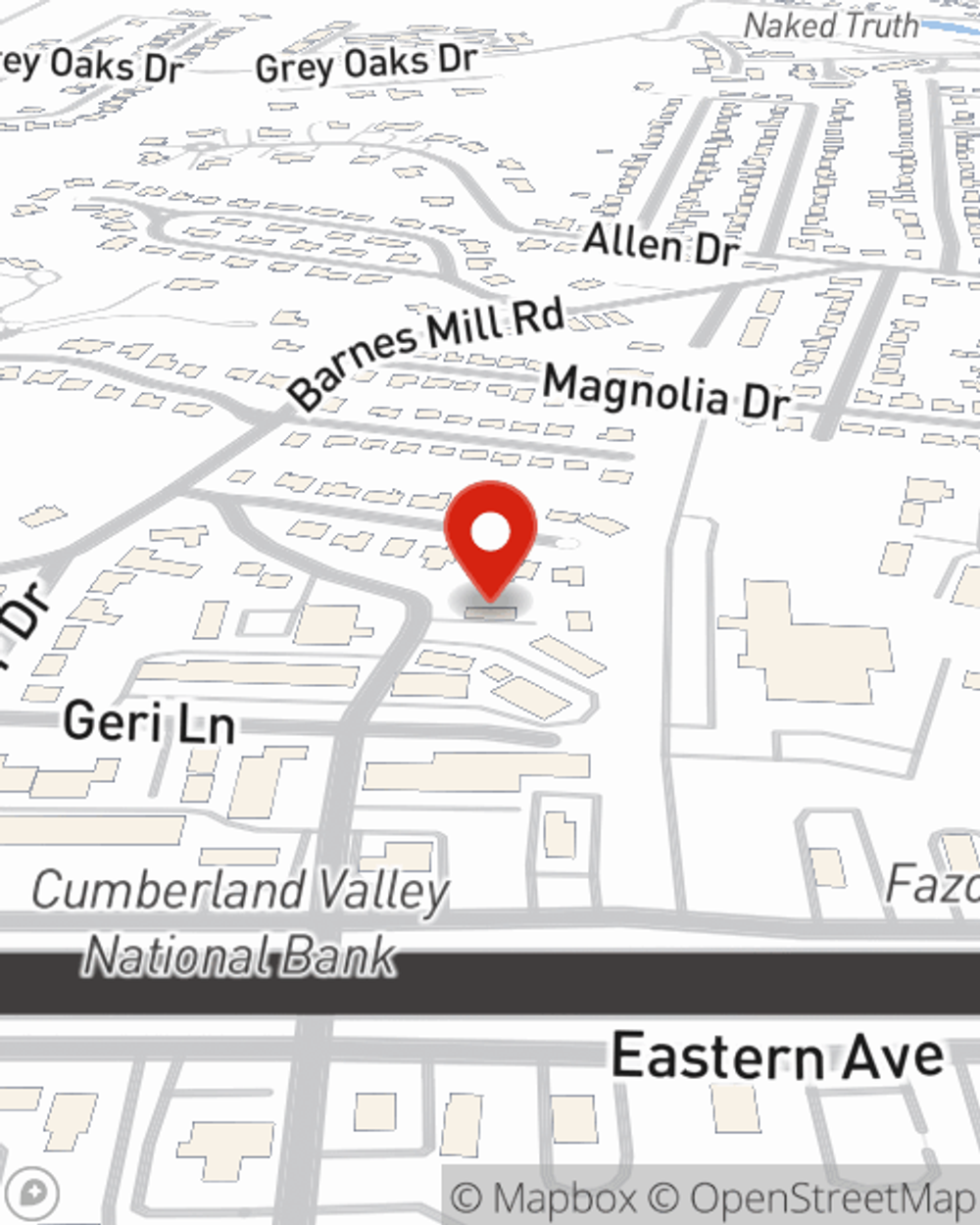

Business Insurance in and around Richmond

Searching for coverage for your business? Look no further than State Farm agent Ashley Williams!

Helping insure businesses can be the neighborly thing to do

- Berea

- Mt. Vernon

- EKU

- Waco

- Madison County

- Boone's Trace

- Irvine

- Ravenna

- Paint Lick

- Lancaster

- Winchester

- Clark County

- Estill County

- Rockcastle County

- Garrard County

- Nicholasville

- Athens

- Berea College

- Jackson County

This Coverage Is Worth It.

When you're a business owner, there's so much to focus on. We get it. State Farm agent Ashley Williams is a business owner, too. Let Ashley Williams help you make sure that your business is properly covered. You won't regret it!

Searching for coverage for your business? Look no further than State Farm agent Ashley Williams!

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a lawn care service or a physician or you own an art gallery or an ice cream shop. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Ashley Williams. Ashley Williams is the agent who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

It's time to get in touch with State Farm agent Ashley Williams. You'll quickly find out why State Farm is the reliable name for small business insurance.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Ashley Williams

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.